by Zohreh Fayaz | Jan 10, 2020 | Blog, Economy, Finance, Homeownership, Mortgage

Buying a home is one of the largest financial investments of your lifetime. And while owning real estate brings with it a sense of stability, achievement and a dream come true, it’s not without a certain element of risk. Mortgage fraud is a growing problem in...

by Zohreh Fayaz | Jan 3, 2020 | Blog, Finance, Homeownership, Mortgage

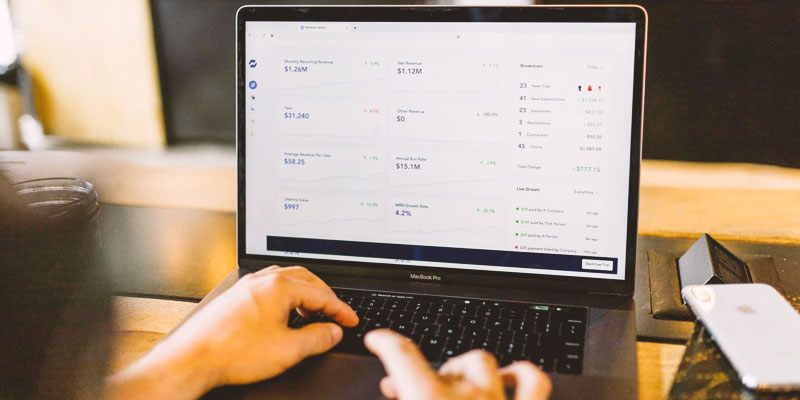

There’s no doubt that your home is an extremely valuable investment – not only because of what it offers in terms of a place for you and your family to live, grow and prosper, but also thanks to the flexibility it provides for tapping into your ever-growing equity. ...

by Zohreh Fayaz | Oct 18, 2019 | Blog, Finance, Homeownership, Mortgage

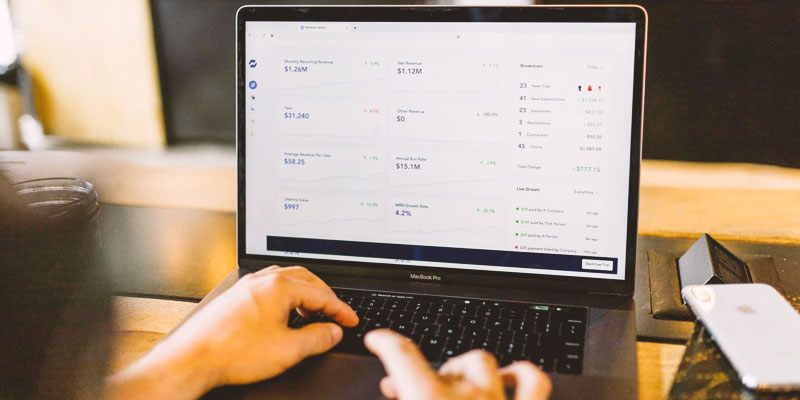

Historically, real estate has proven to be a sound investment option. Nowadays, with rental properties scarce and rental fees through the roof, investing in real estate could be considered a great option, especially if you cater to the right demographic in the right...

by Zohreh Fayaz | Oct 11, 2019 | Blog, Finance, Homeownership, Mortgage

If you’re a Canadian homeowner who’s at least 55 years old, a reverse mortgage may be able to provide a number of solutions for you, including supplementing your current income while you continue to live in your home to help you enjoy a more fulfilling retirement....

by Zohreh Fayaz | Oct 4, 2019 | Blog, Finance, Homeownership, Mortgage

Sometimes, you may just need an added boost to qualify for the loan amount required to get you into your new home, particularly following the introduction of tighter mortgage qualification rules. If you’re experiencing difficulty meeting traditional lender...

by Zohreh Fayaz | Sep 20, 2019 | Blog, Economy, Finance, Homeownership, Mortgage

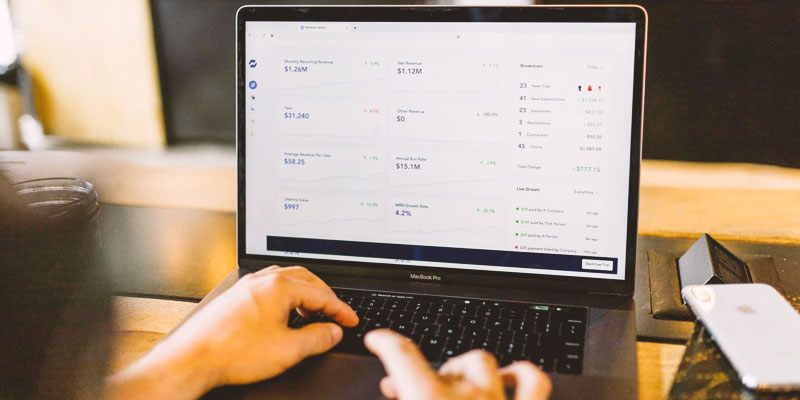

More Canadians than ever before have become familiar with private mortgage options after feeling the effects of the stringent stress test mortgage qualification rules introduced in January 2018. While private mortgages have been around for many years, they were...